Recent situation of novel coronavirus

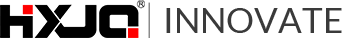

COVID-19 In China

It has taken three months since the outbreak of the Novel Coronavirus in December 2019. Until now, the process of China’s epidemic situation has entered a new stage of international joint control. There are basically no new cases in areas out of Hubei and Wuhan, but strict control is still needed to prevent rebound.

the data of coronavirus of China

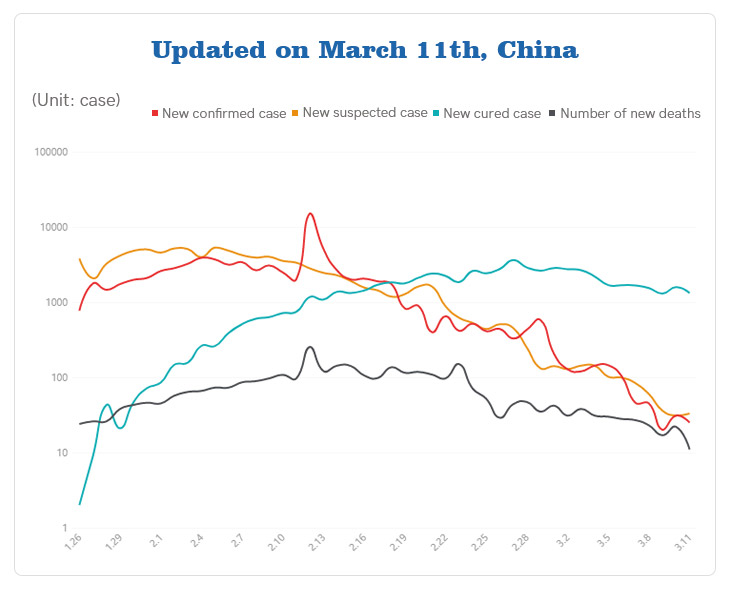

The epidemic situation outside China

The areas out of China are now in the outbreak period and we cannot see any obvious controlling results made by most countries. And Among these areas, the worst situation happens in Asia. The following global distribution map shows the details:

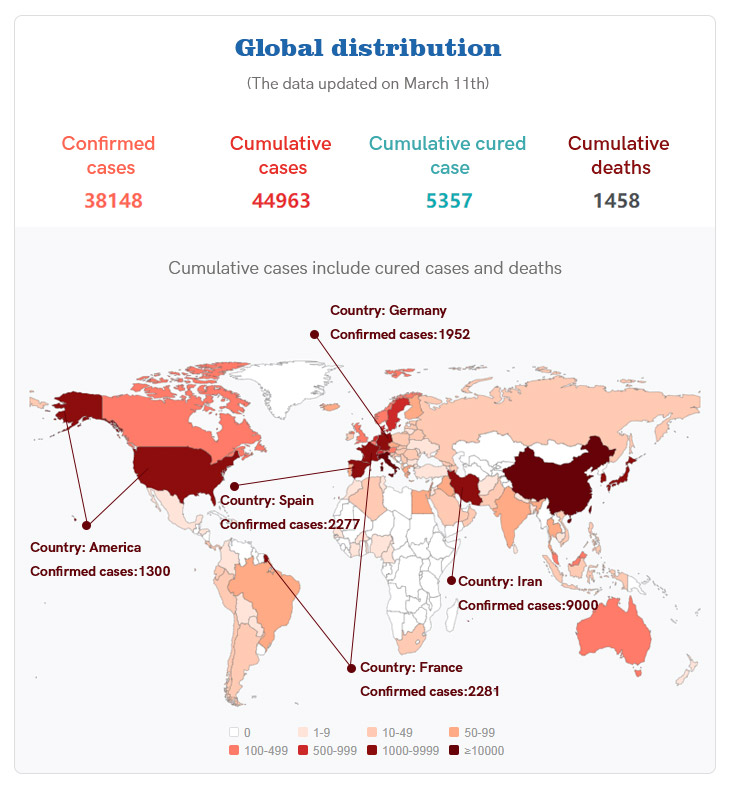

The COVID-19 spreads rapidly around the world

According to official statistics from various countries, coronavirus has Infected at least 83 countries around the world, causing more than 101,700 people being diagnosed with the disease and more than 3,400 people dead. But for positive and scientific measures, China has made a great achievement in fighting this epidemic while the other countries are in their worst period and the following data comparison will show the truth.

The whole world should work together to overcome the difficulities

The impact of novel coronavirus on the world mining industry

Short-term stagnation in the international mining market

China has a significant influence on the international mining market. It is a large producer and consumer of global mineral resources and accounting for a large proportion of the international market in the respect of the demand, orders and mineral products.

The partner of most international mining giants is China. Like Vale has become more and more focused on the Chinese market; Canada, which is a typical mining powerhouse, but due to affected by the global economic situation, looks towards China as its savior. Only by doing it, can Canada change the downturn and tackle urgently needs investment in the national mining industry;

Australia’s Fortsk Metal Group (FMG) is a company born in response to Chinese demand, and 100% of its iron ore is shipped to China. Executives of its company have once stated to the public: “The Chinese market is the reason for our existence. Without China’s growth, there would be no FMG.”

The above has mentioned that Canada and Australia are among the few mining powers in the world while they are so dependent on China, let alone others. The mining industry is one of the important economic pillars of many countries, accounting for more than 20% of the GDP in more than 30 countries in the world.

Since the outbreak has greatly affected the import and export transportation which is dominated by shipping. We all have seen that It has greatly affected the mining economic market or fell into short-term stagnation.

The price of minerals is falling

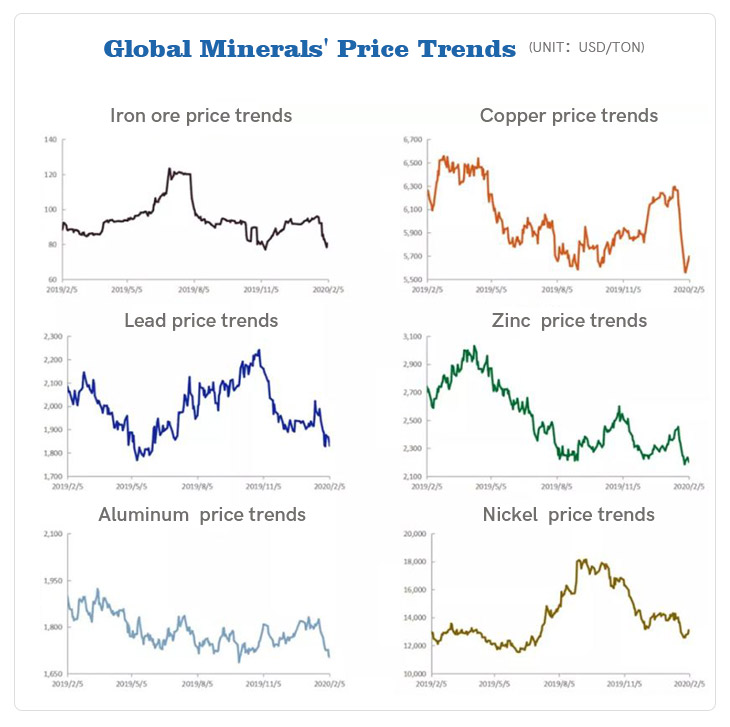

The price of mineral products is a “vane” for the mining market. After the outbreak of the coronavirus, the risk aversion of the market sharply increased, and investors’ expectations for the outlook for the market demand tended to be pessimistic because the prices of iron ore, copper, aluminum, lead, and zinc all fell.

Many ore prices are affected by this epidemic

The most severe impact is on China’s coal and steel industry

Coal industry

50% of coal mines across the country have ceased mining-related production, and most coal mines in Shanxi and Henan, which are the major suppliers, have almost ceased production. According to Today Think Tank data, only 13% of companies in Shanxi, Shaanxi, Inner Mongolia, and the southern region reported less impact from the epidemic which means overall production was relatively stable;

while 28% of enterprises were affected more, with some problems in production; 47% percent of production companies have been severely affected, resulting in a temporary pause in production; moreover, 12% of companies have been severely affected to bankruptcy.

Regarding the main impact of the current epidemic on enterprises’ resumption of work and production, participating companies believe that “poor transportation and logistics transportation” is still the main problem, accounting for 40%.

The second is “decreased labor and personnel supply”, accounting for 24%. The third is the mentality of the epidemic situation: “The epidemic situation is unclear, and they are afraid to resume production blindly”, accounting for 22%, and finally, “reduction in downstream procurement demand” leads to postponement of resumption and production, accounting for 14%.

Coal and oil industry is trying hard to get out of troubles

The impact of the epidemic on the company’s own profits in the first half of the year, 67% of the companies believe that the profit will be reduced by 20-30% year-on-year; 23% of the companies believe that the year-on-year profit will be reduced by 10-20%; 7% of the companies believe that it is basically the same; 3% Some companies see a slight increase.

Steel industry

The downturn in 2019 has spread to before the Spring Festival in 2020, coupled with the impact of the COVID-19 epidemic, postponement of construction and closed management, etc., downstream demand for steel has fallen sharply, which leading steel logistics nearing stagnation, and steel stocks continued to increase.

As enterprises face many pressures such as difficulty in recruiting workers and slow resumption of production, they have to do very hard to normalize their business again. It is expected that from now until the end of the first quarter, the overall production and operation situation of the steel industry is not optimistic. The market trend for the whole year may be low first then go high, but the price level for the whole year will be lower than in 2019.

Steel industry is badly impacted by the disease

Statistics show that steel mills and social inventories were 29.22 million tons last week, and this week has exceeded 30 million tons, which has exceeded the record high of more than 25.3 million tons in 2018.

Experts said that the current inventory has not yet reached its peak, and it should continue the trend of growth for two or three weeks, which means the high point was in March. The industry believes that steel demand in the first quarter will decline by 10% year-on-year, and pessimistic expectations are 20%.

Measures of Chinese institution regarding the current mining situation

| Public institution | Measures |

| State Development Planning Commission of the People’s Republic of China | 1. Strengthen the guarantee of mining labor, land and funds. |

| 2. Implement policies such as tax and fee reductions, financial services, rent reductions and job stabilization subsidies. | |

| National Energy Administration | 1. Supervise and guide coal mines and power plants to strengthen communication and connection, and strictly implement the contract. |

| 2. Ask the railway transportation department to focus on the protection of electric coal transportation | |

| 3. Focus on ensuring the supply of electricity and coal. | |

| 4. Coordinate the coal-producing cities to open green corridors and green passes for coal transportation to ensure the smooth flow of coal. | |

| People’s Bank of China | 1. Put more money exceeding expectations to provide liquidity to ensure sufficient liquidity in the banking system and money market, and to stabilize the mining market sentiment in a timely manner. |

| 2. Establish 300 billion low-cost special re-loans to provide accurate preferential fund support to key enterprises to fight the epidemic. | |

| Ministry of human resources and social affairs | 1. Periodic reduction and exemption of social insurance premiums and medical insurance premiums for mining companies and deferred payment of housing provident funds. |

| 2. Ensure employment through multiple channels. | |

| Ministry of Finance of the People’s Republic of China | 1. Fiscal discount, large-scale fee reduction, deferred tax payment |

| 2. Adjust and improve the repayment and interest payment arrangements of mining companies; increase loan extension and renewal, and appropriately reduce or exempt corporate loan interest. | |

| Ministry of Commerce | 1. The key markets along the “Belt and Road” are to implement one country and one policy to promote smooth trade. |

| 2. Call on WTO members to lift unnecessary restrictions as soon as possible to create a good international trade environment. | |

| Ministry of Environment and Natural Resources | The review of the mine environment protection and land reclamation plan was changed to the letter review. |

| Office of natural resources of Guizhou Province | Simplify the short-term renewal of mining licenses for production coal mines. Expired exploration licenses and mining licenses are extended for three months. |

| Office of natural resources of Shaanxi | Open a green channel to coal mining enterprises applying for a permit or delimiting the area of the mine. |

| Office of natural resources of Henan Province | 1. Suspend the collection of mining rights transfer proceeds. |

| 2. Speed up the transfer of mining rights such as construction sand and gravel. | |

| 3. Support the construction of green mines in the province and alleviate the financial pressure of mining enterprises. |

Mining prospects are worth looking forward to

The outbreak of the new crown epidemic has triggered people’s sentiment about the trend of world commodity prices. Even so, Bambang Gatot Ariyono, Minister of Mining and Coal of ESDM, Indonesia said that the virus outbreak has not yet had a significant impact on the Indonesian mining industry.

Bambang also said that the outbreak in China did not have a significant impact on the export of nickel derivatives such as nickel pig iron (NPI), and mining companies will invest and produce according to this year’s target plan.

Until now, the epidemic situation in China has been under full control. Mining companies are deploying full-scale resumption of production. The policies adopted by the central and local governments have been effective. Major infrastructure projects have been fully rolled out. We would see import and export trade is getting back to normal, even a burst to development.

People are getting back to work orderly

The explosion of industry mergers and acquisitions and the substantial increase in the number of mergers and acquisitions show that mining companies have optimistic expectations for long-term development. By the end of the year, the global mining market will remain in a balanced pattern.